Amendment proposed to address obstacles in obtaining compensation for vehicle damage and personal injuries resulting from accidents

The first reading of a bill to amend the Land Transport Act has been held in Parliament, proposing mandatory comprehensive insurance for all land vehicles. Aimed at establishing a robust mechanism to compensate for damages to both vehicles and operators following accidents, the amendment requires the Maldives Monetary Authority to formulate relevant regulations within three months of the law's enactment. Under this proposed comprehensive coverage, compensation would extend beyond third-party liability to include losses resulting from theft and natural disasters.

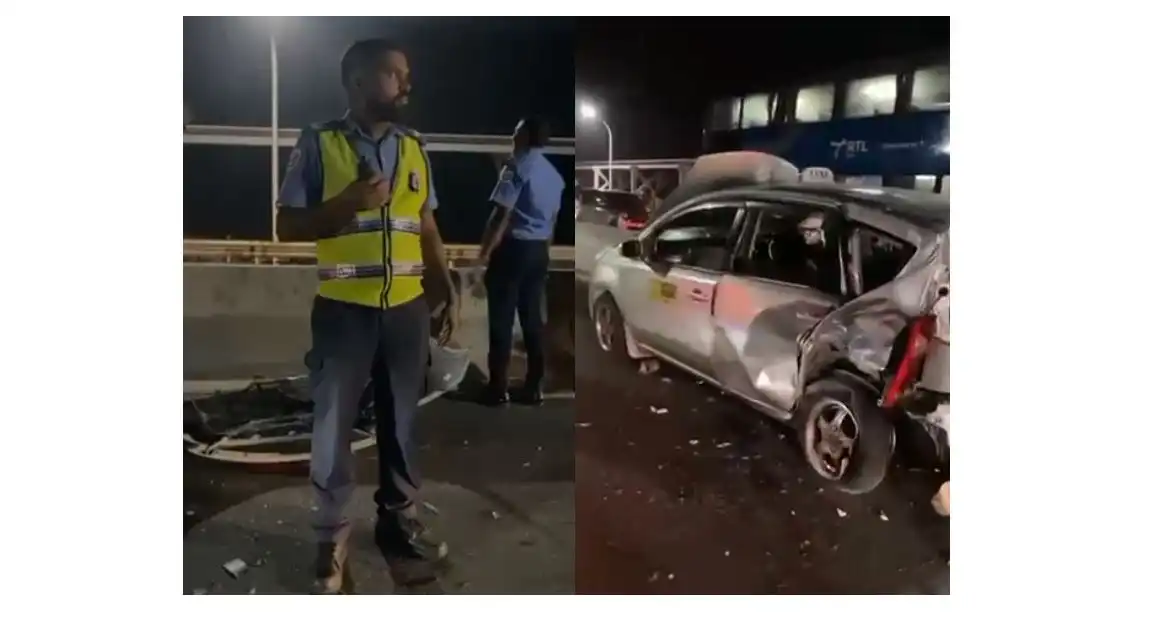

Police attend to the scene of an accident on the highway. | CSM Times | CMS Times

The opposition Maldivian Democratic Party (MDP) has proposed an amendment to the Land Transport Act to address gaps in the current insurance framework. While third-party insurance is mandatory, the lack of a comprehensive motor insurance system currently prevents vehicle owners and drivers from receiving compensation for personal damages or losses to their vehicles.

The first reading of the bill was held during Tuesday's session of the People's Majlis. The bill was introduced on behalf of the MDP by the Member of Parliament for North Galolhu, Mohamed Ibrahim (Kudoo).

The stated objective of the bill is to address the current limitations in the land transport insurance framework. While third-party insurance is currently mandatory in the Maldives, the absence of a comprehensive motor insurance system prevents vehicle owners and operators from receiving compensation for damages or personal injuries, a gap this legislation seeks to resolve.

The bill states that its primary objective is to introduce comprehensive motor insurance, establishing a framework to ensure compensation for damages sustained by both vehicles and drivers in the event of an accident.

The amendment proposed by MP Kudoo calls for the formulation of a regulation on comprehensive motor insurance. It further stipulates that the Maldives Monetary Authority (MMA) must publish this regulation within three months of the law coming into effect.

The proposed amendment mandates that all land vehicles must be covered by comprehensive motor insurance before being operated. This insurance must provide coverage for damages to third parties, property, or objects involved in an accident, as well as compensation for damages sustained by the vehicle itself and the driver.

For the purposes of the law, comprehensive motor insurance refers to insurance policies issued to include a specific set of defined coverages.

This includes coverage for third-party liabilities arising from accidents, such as death, bodily injury, or property damage. Additionally, it covers direct damage to the insured vehicle, including losses resulting from overturning or the impact of a collision.

Furthermore, this includes liability for damages resulting from fire, theft, vandalism, or acts of malicious intent. It also covers liability for natural disasters such as flooding, storms, tidal surges, and other weather-related catastrophes, as well as all other requirements stipulated under the regulations formulated pursuant to the law.