BML introduces device management for internet and mobile banking

Customers can view active sessions and log out from individual and all devices

BML introduces device management for internet and mobile banking

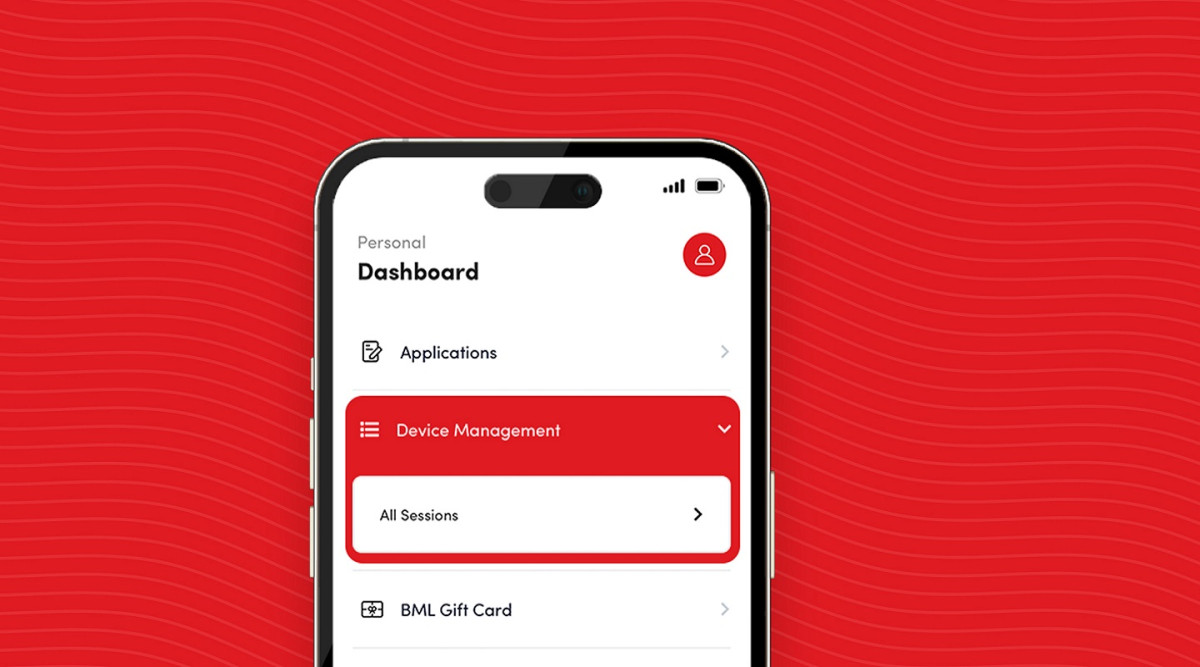

Bank of Maldives (BML) has introduced device management for internet and mobile banking.

BML states that the new device management was introduced as part of the bank's ongoing efforts to enhance security and protect its customers from scams.

The newly introduced device management enables customers to monitor active sessions and log out from devices accessing internet and mobile banking. Customers can view active sessions and log out from individual and all devices.

The Bank’s CEO and Managing Director Karl Stumke commented that the bank is committed to ensure the safety and security of their customers.

He stated that this is evident by their recent efforts to change the systems and introduce many important features that allow customers to proactively protect themselves from scams.

Stumke went onto say that device management feature is launched as an extra layer of security to protect the bank's customers.

He stated that customers can easily view last log in location and device, choose to log out from specific devices or all devices, with this new feature.

BML has taken several steps to protect customers from scams over the past months.

As such, in June, BML introduced a self-service ‘Kill Switch’ to disable access to Internet Banking and cards in emergencies.

In May the Two Factor Authentication (2FA) for Internet and Mobile Banking logins were introduced as an extra layer of security to verify that the login is by the registered customer.

In March, the bank enabled One Time Passwords (OTP) for all Scan-to-Pay payments in addition to alerts for all login attempts on Internet and Mobile Banking.

Last year, the Bank also introduced OTPs via authenticator apps, disabling email as a default OTP channel and began sending push notifications for all Internet and Mobile Banking transactions.

With the nationwide network of 38 branches across all 20 atolls, 87 Self Service Banking Centers, 143 ATMs, over 200 agents and a full suite of Digital Banking services, the Bank is committed to supporting individuals, businesses and communities across Maldives.