MVR 49 million issued to cafés, restaurants in loans for Covid-19 economic recovery

MVR 16 million had been issued to cafes and restaurants through BML

MVR 1.3 billion has been issued to SMEs and private businesses through SDFC so far, since 2019

The government has issued a total of MVR 49 million had been issued to cafés and restaurants deemed small and medium enterprises, in loans as part of the Economic Relief Stimulus packages introduced by the government, says Minister of Economic Development, Fayyaz Ismail.

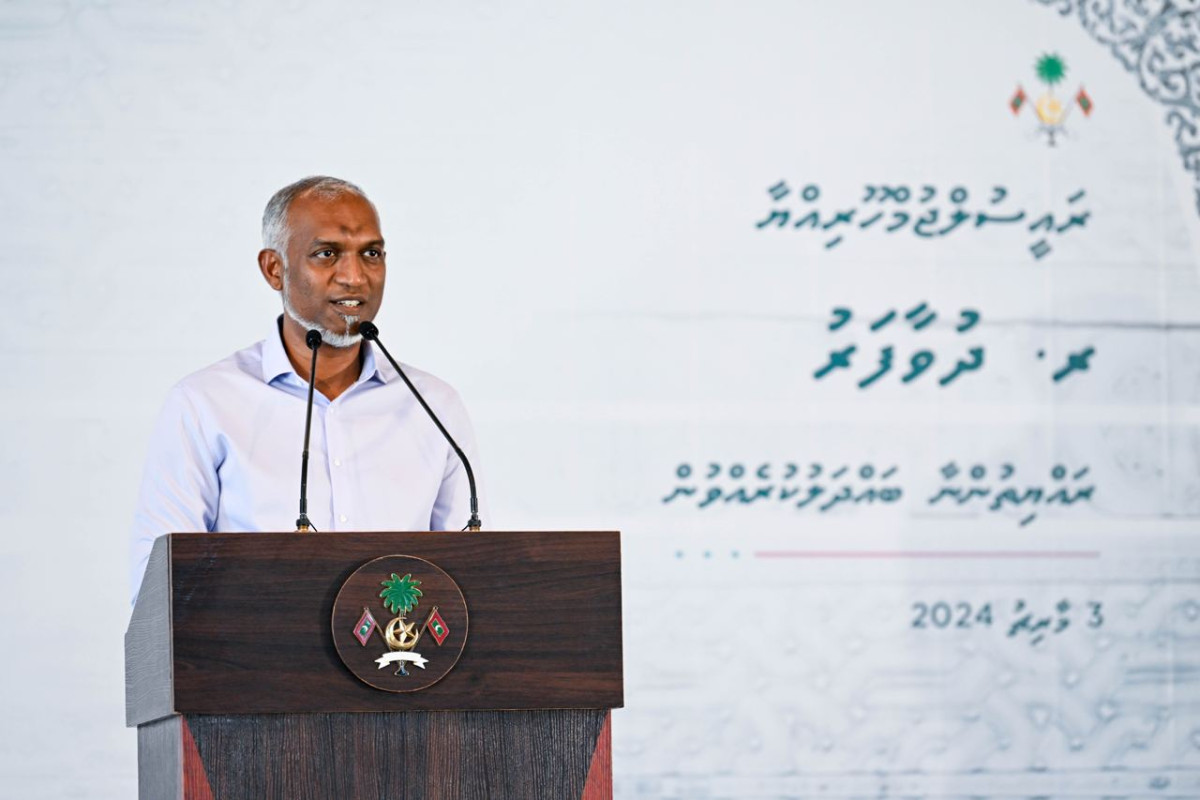

This was revealed during a press conference hosted by the President’s Office on Tuesday afternoon, joined by Minister Fayyaz as well as the Minister of Health, Ahmed Naseem.

Detailing the loan schemes issued under the Bank of Maldives, targeted for struggling Small and Medium Enterprises, Fayyaz noted that five stimulus packages were for cafés, restaurants and food outlets, which is MVR 16 million.

Further, loans had also been issued through the SME Development Financing Corporation (SDFC) totaling MVR 33 million to 156 cafés and restaurants. 90 businesses in the Greater Malé Region received these loans.

Highlighting that MVR 357 million was issued through the national bank under the initial stimulus packages as well as MVR 585 million in loans to bigger enterprises, Fayyaz noted that MVR 363 million was issued in loans through SDFC, to SMEs as well as businesses in the private sector.

Of this, MVR 1.3 billion has been issued to SMEs and private businesses so far, since 2019. This included MVR 363 million in Covid-19 relief loans and MVR one billion issued through the bank. SDFC had approved MVR one-billion-loans to 765 applicants and issued them to 524 individuals.

The government had, as part of their efforts to assist businesses affected by the pandemic, introduced two more loan schemes recently, including the Economic Stimulus Loan to be issued through BML with an aim to boost productivity and economy through businesses affected by the coronavirus, as well as the sustainable stimulus packages for small and medium enterprises being issued through SDFC.

The loan scheme being issued through BML will carry an interest rate of six percent with no requirements for mortgage and a repayment period of four years. Businesses may seek up to MVR 10 million in loans through the initiative with a 12-month grace period.

Further, loans under the Covid-19 sustainable stimulus packages will be issued to operational restaurants, cafés, guesthouses, gyms as well as salons. Three packages are issued under the stimulus loan scheme. As such, the first package, Stimulus package one will be issued to applicants seeking to complete ongoing projects. Stimulus package two will be issued to financially assist businesses run their operations and stimulus package three will focus on expanding businesses in a sustainable manner.

Businesses applying for the sustainable stimulus loan scheme must have had gained profits from their operations for three years, between 2018 – 2020. They are required to have been running operations for the past year.

Up to MVR one million will be issued under the loan scheme and an equity is only required for applicants applying for expansion loans. Businesses will be given a loan repayment period of five to eight years and the loans will carry an interest of six percent per year. A grace period of 12 to 24 months is given under the stimulus loan scheme.

Speaking at the presser, President Ibrahim Mohamed Solih revealed that businesses have faced immense losses and difficulties in the face of the pandemic and that the government has issued MVR 1.7 billion in assistance over the past year, through loan schemes. In addition to loan schemes for economic relief, the government is also issuing income support allowances as well as discounts through utilities companies, for water and electricity bills.

President Solih had engaged in discussions with owners of guesthouses, salons, cafés and restaurants during the past two weeks, where he was briefed on the challenges facing business owners due to the restrictions and precautionary measures the government recently implemented after a fourth Covid-19 wave was confirmed.