FinCEN Files: two banks in Maldives in suspicious transactions list

The files show that over a half a million dollars transferred into two banks in the Maldives, were flagged as suspicious

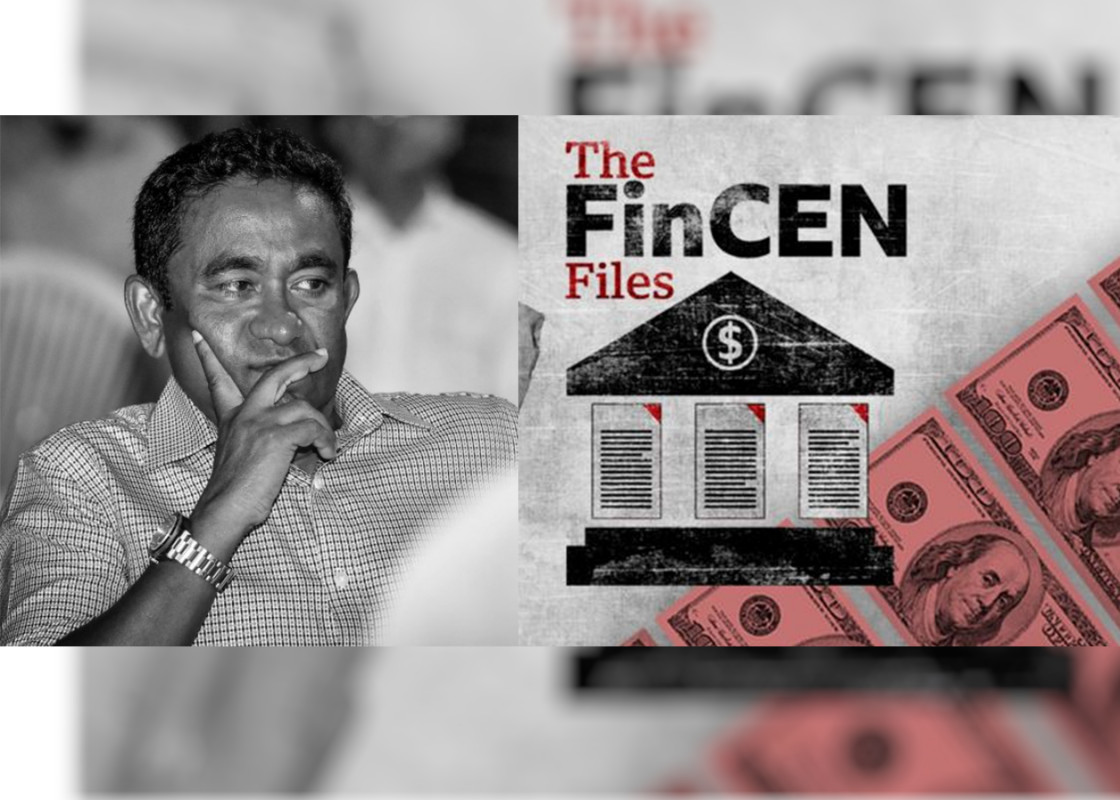

(Cover photo)

Leaked documents from the United States Department of Treasury’s Financial Crimes Enforcement Networn (FinCEN) claims that over a half a million dollars transferred into two banks in the Maldives, were flagged as suspicious.

The FinCEN files were investigated by the International Consortium of Investigative Journalists (ICIJ), and publicized on Sunday.

While the reports describe over 200,000 suspicious financial transactions that occurred from 1999 to 2017 across multiple global financial institutions, it implicates financial institutions in more than 170 countries who played a role in the facilitation of money laundering and other fraudulent crimes. BuzzFeed News claims that the files "offer an unprecedented view of global financial corruption, the banks enabling it, and the government agencies that watch as it flourishes."

The FinCEN files also claims that the banks and the United States government “did little to stop activities such as money laundering” despite having the financial intelligence.

In regards to Maldives, the files show 18 transactions flagged as suspicious, however, no suspicious transfers were made out of Maldives during these time periods. The transactions flagged as suspicious are; 12 transactions - a total of USD 296,928- to the State Bank of India (SBI) in capital Male', between 17th September 2015 and 17th March 2016; and six transactions amounting to USD 204,431 to Hong Kong And Shanghai Banking Corporation Limited (HSBC) in Male', between 27th November 2015 and 8th March 2016. The transfers were made by China Investment Corporation through VP Bank AG.

It is important to note that all 18 transactions were made during former President Abdulla Yameen’s tenure. While Yameen served as president from 2013 to 2018, he faced various corruption allegations throughout his tenure, and was found guilty of money laundering in 2019. He is currently serving a five-year jail sentence, and is facing other similar charges as well.

FinCEN is in charge of compiling "suspicious-activity reports" or SARS, sent to it by banks that suspect financial wrongdoing by their clients. While SARs do not constitute evidence of wrongdoing but are a way to alert regulators and law enforcement, the documents are shared with law-enforcement and financial-intelligence groups around the world.

Research and Research and Policy Expert on Corrupt Money Flows at Transparency International, Maira Martini said the FinCEN files “are further proof that the global anti-money laundering system is broken. Banks are meant to be the first line of defence against corrupt money flows, but without proper supervision and accountability for banks and their employees, they have little incentive to cut off suspicious clients. It is not enough to submit poor-quality or delayed Suspicious Activity Reports and continue processing payments.”