MMA, Finance and MPs discuss interest plan for overdraft repayment

The Minister of Finance assured that the state would be working to repay the overdraw as income is earned

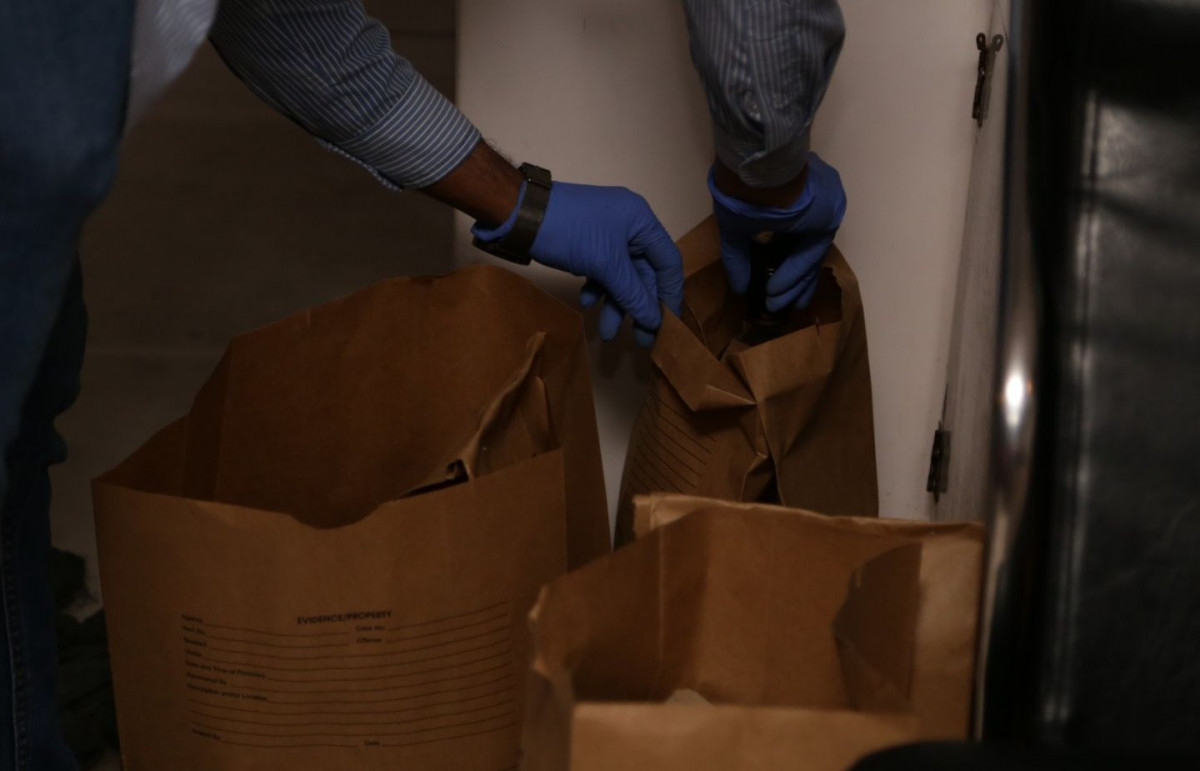

Finance Minister Ibrahim Ameer at the committee meeting held at parliament on Wednesday to discuss solutions to the state's overdraw

A special committee meeting was held at the People's Majlis on Wednesday, where Minister of Finance Ibrahim Ameer, Governor of the Maldives Monetary Authority (MMA) Ali Hashim and Auditor General Hassan Ziyath were called into attendance to discuss the overdraw extension under the Fiscal Responsibility Act, as requested by the Ministry of Finance.

While the special committee meeting was held on Wednesday afternoon, several MPs in attendance raised concerns that extending the repayment period for the overdraw could have lasting economic repercussions.

The Ministry of Finance has requested an extension period for an overdraw taken from the Maldives Monetary Authority on 26 April 2020, which totals MVR 4.4 billion. Many parties have since come forward to note how critical it is that the overdraw be paid as required under the Fiscal Responsibility Act.

Minister of Finance Ibrahim Ameer had requested the extension as the Maldives' economy has still not recovered from the downturn caused by Covid-19, noting that the state would be working to repay the overdraw as income is earned. Finance Minister Ameer went on to express hopes that the overdraw could be settled before the end of the year.

MMA Governor Ali Hashim and Deputy Governor Ahmed Imad highlighted the importance of having a robust repayment plan for the overdraw, which had been noted last year before the overdraw had initially been issued.

As the Maldives' central bank, MMA's biggest concern is that the overdraw amount not exceed MVR 4.4 billion already issued. MMA revealed that increasing the overdraw carried the risk of economic setbacks such as increased cost of goods and services.

During the meeting, Minister of Finance Ibrahim Ameer repeatedly stated that they would not be seeking to increase the overdraw amount.

Under the Fiscal Responsibility Act, the government can only overdraw from MMA an amount that is equivalent to one percent of the state's average revenue, which is roughly MVR 170 million based on past figures. The Fiscal Responsibility Act also requires that the state repay the loan to MMA within 91 days of it being issued.

In April last year, the Ministry of Finance requested for an overdraw of MVR 4.4 billion, which had been approved by the People's Majlis where main-ruling MDP holds a super-majority. The overdraft extension issued last year is due to end on 26 April 2021. The Ministry of Finance has since requested an extension for the overdraw limit, and to extend periods of suspension for some clauses under the Fiscal Responsibility Act which make the state liable to repay the overdraft within a one year period.

At the committee meeting to review Finance Minister Ameer's request for the extension, discussions also centered around a potential financial cost or interest plan for the repayment of the overdraw.

Differences of opinions were noted, with others including the MMA's Governor calling to include a disciplinary push for the repayment of the overdraw. MMA's Governor Hashim noted that an interest plan could incentivize the state to repay the overdraw within the required time limit. When asked about the potential rate of interest, the central bank's Governor stated that an amount not smaller than the T-bill rate would be sought by MMA as interest for the overdraft repayment.

In addition to this, Auditor General Hassan Ziyath also supported MMA's proposal to include a financial cost to incentivize the state to repay the overdraw. However, the Auditor General stressed that the matter would need to be resolved by the Maldives Monetary Authority and the Ministry of Finance.

Some MPs, along with Finance Minister Ibrahim Ameer, were opposed to the inclusion of an interest plan for repaying the overdraw. In countering the proposal, Finance Minister Ameer stated that they had only requested the extension out of necessity, and that including a financial cost or interest plan to incentivize the repayment would be too much of a burden on the state.

Members of parliament who supported Minister Ameer also highlighted that it would not be feasible to include an interest plan, which would incentivize repayment of the overdraft, as it would be an additional financial burden on the state. MPs noted that now was not an ideal time to incentivize the state with a financial cost, as the interest in repaying the overdraw would ultimately be allocated from the state's budget, which would be a detriment to the citizens entitled to those funds for the improvement of their standard of living.

Speaking at the committee meeting, MMA Governor Ali Hashim underlined the importance of devising a repayment plan for the overdraft issued. Based on analysis of the Maldives' short-term economic forecast and the state's cash-flow at the time the overdraw facility was issued, the MMA also recommended that the committee establish a duration for extending the overdraw.

In response, members of the committee noted that the overdraw was taken with the explicit intension of repaying it, and that the Ministry of Finance would be proceeding to do so within the one year period as required. As such, members raised the question of what plan would be needed in order to achieve repayment of the overdraw, to which the Governor of MMA replied that the overdraw facility was a tool used to sustain a weak cash-flow. The Governor added that the overdraw must be repaid steadily as the cash-flow improves, and that if an overdraw was not repaid in the final fiscal quarter of an year, it would remain uncleared for the two or three months that followed.

The central bank's governor also noted that they had not been able to manage last year's cashflow beacsue of the overdraw. The Governor added that they working to avoid such a possibility this year by decreasing the amount needed to be repaid for the overdraw under MVR 1 billion by the end of the year.

Aside from including a repayment plan for the overdraw, the Maldives Monetary Authority has also proposed a payment review process. MMA Governor Ali Hashim has suggested a 6-month review window where the repayment of the overdraw, noting that the Ministry of Finance was also on-board, although it has not yet been decided if the review will be held quarterly or bi-annually. Governor Hashim remarked that it might be inconvenient to hold quarterly reviews, but maintained that a bi-annual review process would help authorities assess economic recovery and the state's capacity to generate revenue.

Further, some members in attendance at the committee pushed to have this be the final instance where the overdraw repayment was extended. Other members argued that it would not be a feasible way forward based on the state of the world's economy following the global Covid-19 pandemic. Early projections state that the Maldives will be able to achieve economic recovery from the downturn caused by Covid-19 in the year 2023.