BML customers can now link cards to PayPal accounts

BML blocked select PayPal merchants to minimize customer exposure to fraudulent transactions recently

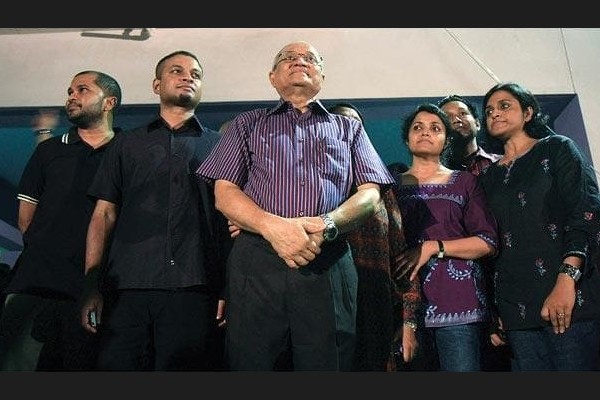

Bank of Maldives

The Bank of Maldives (BML) has reversed its recent decision to block select merchants on PayPal, allowing customers to link their BML cards to PayPal accounts once again.

This was revealed via an announcement publicized on Thursday.

The national bank blocked select PayPal merchants to minimize customer exposure to fraudulent transactions, following an alarming increase in the number of unauthorized transactions. This in turn restricted customers from linking their BML cards to PayPal accounts.

“With a large increase in the number of unauthorized transactions, we recently blocked selected PayPal merchants to minimize exposure of our customers to fraudulent transactions. This measure was taken in line with standard practice to protect our customers. As a result of blocking these merchants, customers also faced an issue in linking BML cards to their PayPal accounts.” Bank of Maldives.

The measure was taken in accordance with the standard procedure to protect customers.

Since all of the blocked PayPal merchants have now been unblocked, customers can now add BML cards to their PayPal accounts.

The bank went on to assure that they will continue to monitor transactions and if similar incidents are observed, further steps to safeguard customers will be enforced and merchants will be blocked consecutively.

All BML cards are protected by 3D-secure authentication to validate purchases, prevent unauthorized use and prevent financial loss for customers, said the bank.

The bank urged customers to review card and account activity for transactions they do not recognize and inform the bank of any suspicious transactions.

According to BML, unauthorized transactions must be disputed no longer than 30 days after the date of the transaction.