Maldives to collect departure tax from travelers starting January 2022

Parliament passed the amendment on July 5

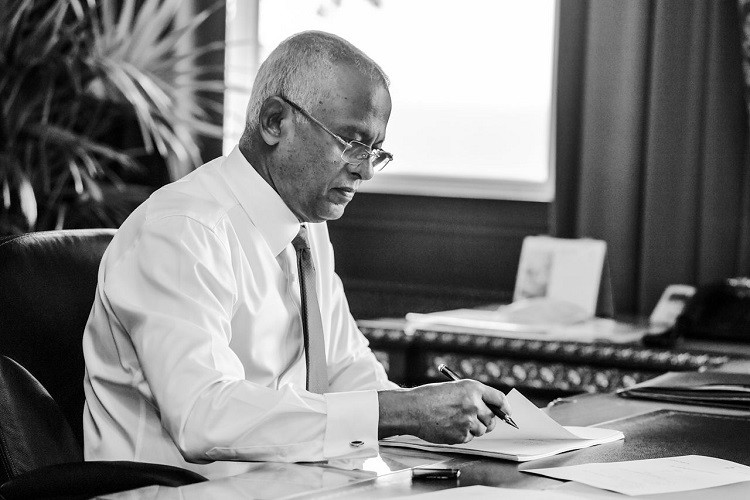

President Ibrahim Mohamed Solih

The government is to introduce a Departure Tax instead of Airport Taxes and Fees charged from travelers leaving from local airports in the Maldives, from January 2022.

President Ibrahim Mohamed Solih ratified the first amendment to the Airport Taxes and Fees Act on Sunday, with which the government will be collecting departure taxes from all passengers departing from airports throughout the Maldives, in accordance with the set fee schedule.

The People’s Majlis passed the amendment to introduce the Departure Tax on July 5, at the 18th sitting of the second session of the year.

The taxes are to be collected from 1 January 2022 onwards and the Airport Service Charge will remain in effect until the end of the ongoing year. Passengers with diplomatic immunity and children under two will be exempt from Departure Taxes.

Further, the amendment ratified on Sunday mandates the authorities to introduce an Airport Development Fee to be imposed on all travelers flying international through the Velana International Airport.

Following implementation, individual airlines will be tasked with collecting the Airport Service Charge, Airport Development Fee and Departure Tax and airports from which flights depart will be responsible for forwarding tax money to the government.

Monthly bookkeeping and record-keeping of passenger departures are also stipulated under the amendment. Further, the taxes and fees collected must be submitted to Maldives Inland Revenue Authority (MIRA) before 28th of the month that follows in accordance with sample documents.

All charges imposed under the amendment are required to be settled in USD

MP for North-Fuvahmulah constituency, Mohamed Rasheed submitted the amendment bill on behalf of the government on 12 April 2019.

The legislation noted that both locals and foreigners travelling in business class will be charged USD 60, with those travelling in the first class having to pay USD 90. Foreigner traveling from economy class are required to pay taxes priced at USD 30, with Maldivians having to pay USD 12.

The tax will be priced at USD 120 for travelers leaving via private jets.